When you’re you can find great mortgage options available having small businesses, fraction women usually see themselves incapable of keep the funding it you would like.

In this post, we’ll discuss the 17 greatest home business fund having minority girls that will help get your own small business suggestion off the ground. Let’s start!

What’s Minority Financing?

Fraction credit is a kind of home business mortgage which is specifically designed to have fraction-possessed organizations. This includes small business financing to possess fraction female. There are various particular finance getting fraction business owners, but some quite well-known is SBA 7(a) and you can 504 loans. These types of money can be used for several things, along with to help with begin-upwards costs or even expand dependent people.

personal loan companies in Memphis TN

The significance of Funding To have Minority Ladies-Possessed Smaller businesses

Small business financing to own minority girls help to peak the latest to play job by giving money such as a corporate credit line which can be used to begin with or grow a corporate.

17 Most readily useful Lending options for ladies-Owned Companies

These day there are so much more small business lending products readily available than ever before before for ladies advertisers. However, with so many options available, it can be difficult to know where to start.

step 1. SBA People Advantage Fund

The small Business Government (SBA) People Virtue Mortgage is a great option for nonprofit communities or other businesses with a high credit history. The program even offers finance of up to $250,000 which have aggressive terms and conditions and costs.

One of several conditions into loan try a leading minimum credit score out of 600 or higher. Women entrepreneurs may want to consider this financing, because offers unique benefits having companies owned by females.

2. Credit Unions

A card relationship is a fantastic capital selection for businesses, specifically females-possessed organizations. Females usually takes a company loan that have aggressive rates and you may terms and conditions.

step 3. CDFI Loans

A community Innovation Financial institution (CDFI) was a bank one focuses primarily on loaning currency so you can minority quick advertisers into the lower-money or upset groups. The federal government developed the CDFI Funds in 1994 with Camino as the first neo-CDFI in the nation. They normally use fake intelligence to aid fund business owners.

4. Short-Identity Loans

Short-title loans for females are generally simple to be eligible for and they are an effective option for businesses that you desire quick cash. The finance have regards to six to couple of years and will be studied many different objectives.

5. Team Charge card

It lowest-pricing team loan option is ideal for an entrepreneur whom needs to make short sales or requires usage of a line from borrowing from the bank. These types of playing cards normally have reasonable interest levels and supply rewards for example cashback or issues that are used for traveling.

Such business loans for ladies make it residents to borrow on unpaid statements. This really is an excellent choice for companies that has actually a large amount of receivables but you need quick cash.

eight. Business Grants

Offers for women-had smaller businesses are a great way locate financing without needing to pay back the cash. Provides are usually issued by authorities or foundations in order to people you to meet certain criteria.

8. Peer-to-Fellow Loans

These business mortgage are financed from the investors alternatively out of banking companies. These types of financing is going to be an excellent option for businesses that can get maybe not qualify for a timeless financial loan.

nine. Working-capital Loans

This really is a corporate loan that’s always loans the day-to-day procedures away from a corporate. This type of financing can be used for various objectives including because the inventory, payroll, or income.

10. SBA Microloan

The tiny Business Government Microloan System is a government-funded system that give funds as much as $50,100 to help you companies. Brand new financing has terms of up to six ages and certainly will be taken for the majority of organization aim.

11. Venture capital

We have found a form of investment that’s provided with buyers so you’re able to companies with a high increases potential. Promotion capitalists typically purchase firms that are located in early stages of development.

several. Antique Banking companies

This is certainly a beneficial selection for firms that have a great credit history and you will strong financials. Banking companies normally bring finance that have reduced-interest rates and you may long terms and conditions.

13. Gizmos Capital

This will be a kind of lending that enables businesses to acquire the fresh or put devices outright, to your financing are secured because of the products alone. Organizations can get while making monthly payments over a period of a few to help you five years.

14. Nonprofit Financing

Nonprofit fund is a type of financing which is provided by an effective nonprofit team. These types of loans can be used for various purposes and you will will often have lowest-rates of interest.

fifteen. Line of credit

A business line of credit is a type of financing you to definitely allows people entrepreneurs so you’re able to borrow on an appartment amount of funds and you can shell out attention only on that lent number.

sixteen. On line Bank

On the internet loan providers promote several money so you can companies. On the internet lenders will often have prompt approval minutes getting internet business loans and will be an effective selection for firms that you want quick bucks.

17. California Finance Bank Loans

California Funds Lender Money was a kind of mortgage that’s open to small enterprises inside Ca. These types of small company money enjoys the lowest to help you no minimum borrowing from the bank score specifications and will be taken for a variety of objectives

The application form Process

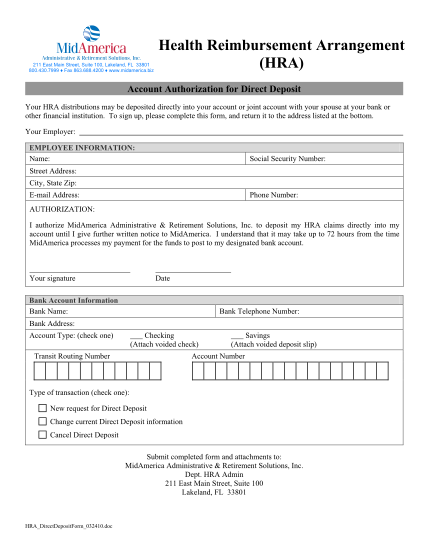

There are many different applications offered to let small businesses, including minority women-had enterprises. The applying procedure for those programs are going to be complicated, but following the 3 tips in depth less than, you might raise your possibility of protecting small business money.

- Get the documents managed. Step one to have women business owners is to get the records under control. This includes the company bundle, monetary comments, tax statements, and just about every other relevant files.

- Choose the best lender. The next action is to obtain the proper financial. There are a number of loan providers just who are experts in financing minority people.

- Sign up for funding. The final action is to apply having financial support. You can do this on line, of the cell phone, or even in person.

What’s the ideal financing for women small business owners?

This may are very different according to the need away from individual women advertisers. Although not, some of the most preferred possibilities are SBA loans eight(a) and you will 504, financial otherwise borrowing relationship funds, providers handmade cards, and dealing money fund. Each of these selection possesses its own group of gurus and you may downsides, it is therefore crucial that you examine him or her before carefully deciding into better mortgage for the particular team demands.

Leave A Comment